In the dynamic landscape of modern business, traditional financial valuation methods often fall short when faced with uncertainty and the need for adaptive decision-making. This is where the powerful concept of real options Wenatchee emerges as a game-changer, offering businesses a framework to value and manage strategic flexibility. Unlike passive investments, real options acknowledge that management has the right, but not the obligation, to take future actions based on evolving circumstances, much like financial options give the holder the right to buy or sell an asset.

For businesses operating in a vibrant, yet sometimes unpredictable, regional economy like Wenatchee, understanding and applying real options can mean the difference between merely surviving and truly thriving. It's about recognizing the inherent value in adaptability, in being able to pivot, expand, delay, or abandon projects as new information comes to light. This article will delve deep into what real options are, why they are particularly relevant for Wenatchee's unique economic environment, and how local businesses can harness this strategic tool to make more informed and resilient investment decisions.

Table of Contents

- Real Options Wenatchee: A Paradigm Shift in Decision-Making

- What Are Real Options? Beyond Financial Theory

- The Wenatchee Context: Where Real Options Shine

- Identifying Real Options in Your Business

- Valuing Real Options: Practical Approaches

- Implementing Real Options in Wenatchee: Case Studies and Opportunities

- Challenges and Considerations in Real Options Analysis

- The Future of Strategic Investment in Wenatchee

Real Options Wenatchee: A Paradigm Shift in Decision-Making

The concept of real options represents a fundamental shift in how businesses approach investment and strategic planning. Instead of viewing projects as static, irreversible commitments, real options encourage a dynamic perspective, acknowledging that future decisions can be made based on new information. This flexibility holds significant value, especially in environments marked by volatility, such as emerging markets or regions undergoing economic transformation. For businesses considering growth or new ventures in Wenatchee, a city known for its vibrant agricultural sector, burgeoning tech scene, and tourism, understanding this paradigm is crucial. It’s about recognizing that the "real" in real options refers to options on real assets – tangible assets like land, buildings, equipment, or even intangible assets like patents and market opportunities – rather than purely financial instruments. It’s about making decisions grounded in the real world, with real people and real challenges.What Are Real Options? Beyond Financial Theory

At its core, a real option is the right, but not the obligation, to undertake a business initiative in the future. This strategic flexibility is often embedded within projects, yet frequently overlooked by traditional valuation methods like Net Present Value (NPV). Imagine a company in Wenatchee considering a new packing facility. A traditional NPV analysis might give a static value. However, a real options approach would recognize the option to expand the facility if demand surges, the option to delay construction if market conditions worsen, or even the option to abandon the project if it proves unviable. These embedded options add significant value to a project, as they allow management to adapt to future uncertainties. Just as "real girl fridays are intended to celebrate ourselves as people in the real world," real options celebrate the human element of strategic thinking, allowing businesses to adapt and thrive in the real world, not just in theoretical models.Types of Real Options: Understanding Your Choices

Real options manifest in various forms, each offering a unique kind of flexibility: * **Option to Expand:** The right to increase the scale of a project if market conditions are favorable. For instance, a winery in Wenatchee might invest in a small initial vineyard with the option to purchase adjacent land and expand production if their wine gains popularity. * **Option to Contract/Abandon:** The right to scale down or completely cease a project if conditions are unfavorable, limiting potential losses. A new tech startup might lease office space with a short-term break clause, an option to abandon if their product doesn't gain traction. * **Option to Delay/Defer:** The right to postpone an investment until more information is available or market conditions improve. A developer might purchase land in Wenatchee but delay construction of a new housing development until interest rates stabilize or population growth forecasts become clearer. * **Option to Switch:** The right to switch inputs or outputs of a production process. An apple processing plant might have the option to switch between producing juice, dried apples, or fresh fruit based on market prices and supply availability. * **Option to Grow/Follow-on:** An initial investment that creates opportunities for future, valuable projects. Investing in a new distribution hub in Wenatchee could create follow-on options for expanding into new regional markets. These options are powerful because they allow businesses to respond proactively to the "real" challenges and opportunities presented by the market, much like a community of "real people having fun and sharing some saucy" insights adapts to new trends.Why Traditional NPV Falls Short

Traditional NPV analysis assumes a static, "all-or-nothing" decision at the outset of a project. It discounts future cash flows based on a fixed discount rate, without accounting for management's ability to alter the course of a project in response to new information. This often leads to understating the true value of projects, especially those with significant strategic flexibility or high uncertainty. For example, a project might have a negative NPV if undertaken immediately, but if it includes an option to delay until a critical piece of technology matures, its real option value could make it highly attractive. Relying solely on static models is like trying to understand "real housewives of Atlanta | Beverly Hills | New Jersey | New York City | Orange County | Melbourne" based only on a single episode – you miss all the dynamic interplay and future possibilities. Simplistic models are often "not the real thing."The Wenatchee Context: Where Real Options Shine

Wenatchee, nestled in the heart of Washington State, presents a unique economic environment where real options analysis can provide significant advantages. Its economy is diverse, encompassing agriculture (especially apples), hydropower, tourism, and a growing tech sector. This diversity, while a strength, also introduces various uncertainties: * **Agricultural Volatility:** Fluctuations in crop yields, commodity prices, and international trade policies directly impact local growers and processors. An option to switch crops or processing methods can be invaluable. * **Tourism Seasonality:** The influx of tourists varies with seasons, weather, and broader economic conditions. Hotels and recreational businesses can benefit from options to expand services during peak times or contract during off-seasons. * **Technological Shifts:** The burgeoning tech industry requires constant adaptation to new technologies and market demands. Startups and established firms alike can use real options to manage R&D investments and product development cycles. * **Infrastructure Development:** Decisions around new roads, utilities, or broadband expansion require long-term vision but also flexibility to adapt to population shifts or funding changes. In such an environment, where "real Debrid servers are down/undergoing maintenance" can disrupt digital access, or where global supply chains face unexpected challenges, the ability to pivot and adapt is not just an advantage; it's a necessity. Businesses that embrace a real options mindset are better equipped to navigate these complexities, ensuring their investments are resilient and responsive to the "real world" conditions of Wenatchee.Identifying Real Options in Your Business

The first step in leveraging real options is to recognize them. They are often embedded within projects, disguised as managerial flexibility or strategic choices. This requires a shift in perspective from viewing a project as a fixed plan to seeing it as a series of contingent decisions. Ask yourself: * What future choices might this initial investment enable? * What external factors could significantly alter the project's viability? * Can we delay a decision until more information is available? * Are there opportunities to scale up or down based on market response? * Can we switch technologies, inputs, or markets if conditions change? Identifying these options is crucial. It’s about looking beyond the immediate financial numbers and understanding the strategic pathways a project opens up. It’s about recognizing the "real" possibilities, not just the static projections.The Importance of Real Data and Community Insights

For real options analysis to be effective, it must be grounded in "real" data and insights from the community. This means more than just financial spreadsheets. It involves: * **Market Research:** Understanding local demand, competitive landscape, and consumer preferences in Wenatchee. * **Economic Forecasts:** Keeping abreast of regional and national economic trends that could impact your business. * **Technological Intelligence:** Monitoring advancements that could create new opportunities or render existing processes obsolete. * **Community Feedback:** Engaging with local stakeholders, customers, and even competitors to gather "honest opinions" and understand the pulse of the market. "This is a community of real people having fun and sharing some," and these insights are invaluable. Just as "posts showing anything other than live people or... not drawings, cartoons, and whatnot" are preferred in certain communities for their authenticity, real options analysis thrives on authentic, real-world data. It's about moving beyond abstract models to incorporate the messy, unpredictable, yet valuable realities of the market.Navigating Uncertainty and Adaptability

The core value of real options lies in their ability to help businesses navigate uncertainty. In Wenatchee, where local economies can be influenced by everything from global trade disputes impacting apple exports to regional tourism trends, uncertainty is a constant. Real options provide a structured way to think about this uncertainty, not as a barrier, but as a source of potential value. By embedding flexibility, businesses create a portfolio of choices that can be exercised when uncertainty resolves, or new information becomes available. This proactive adaptability is what makes businesses resilient. It’s about being prepared for when "your real Debrid subscription has expired" or when "real 9anime if all others are blocked in your region" requires new mirrors – anticipating disruptions and having alternative paths ready.Valuing Real Options: Practical Approaches

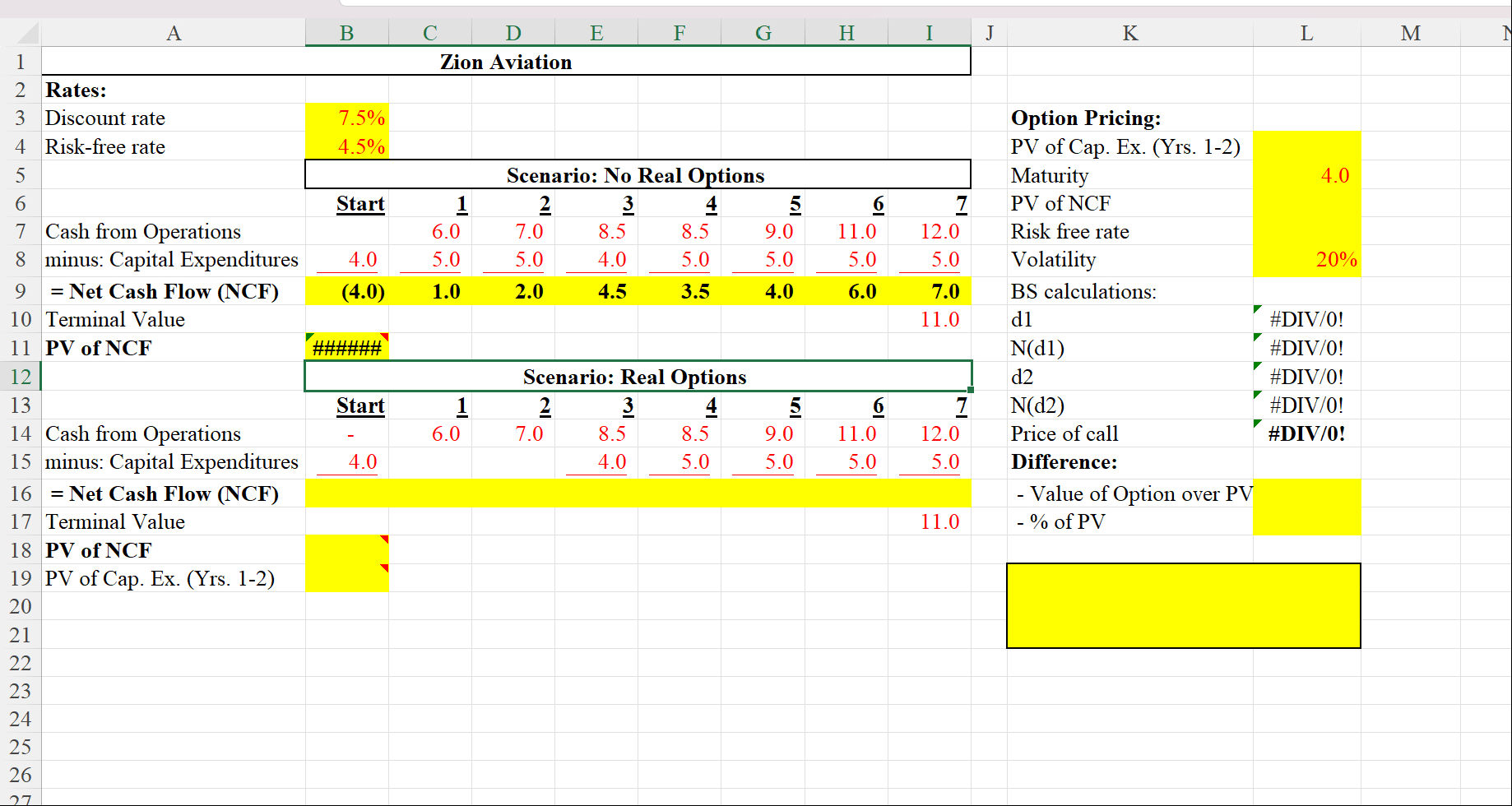

While the concept of real options is intuitive, valuing them can be more complex than traditional NPV. Since real options behave like financial options, their valuation often borrows methods from option pricing theory, such as the Black-Scholes model or binomial trees. However, these models need to be adapted for real assets: * **Volatility:** Instead of stock price volatility, one needs to estimate the volatility of the underlying project value or cash flows. * **Exercise Price:** This is the cost of undertaking the next stage of the project. * **Time to Expiration:** The period over which the option can be exercised. * **Risk-Free Rate:** The rate of return on a risk-free investment. For many practitioners, especially in smaller businesses, sophisticated option pricing models might be overkill. Simpler approaches include: * **Decision Trees:** Mapping out various decision points and outcomes, assigning probabilities, and calculating expected values. * **Scenario Analysis:** Evaluating project value under different optimistic, pessimistic, and most likely scenarios, and then considering the value of flexibility to switch between these. * **Qualitative Assessment:** Sometimes, simply identifying and acknowledging the existence of real options, even without precise valuation, can significantly improve decision-making by fostering a more flexible mindset. The key is to move beyond a single-point estimate and embrace a range of possibilities, understanding that the value of flexibility itself is a significant asset.Implementing Real Options in Wenatchee: Case Studies and Opportunities

Let's consider how real options Wenatchee could be applied in specific local contexts: * **Agricultural Technology:** A Wenatchee-based agricultural firm considering investing in new automated harvesting equipment. Instead of a large, immediate outlay, they could: * **Option to Pilot:** Invest in a smaller-scale pilot program first (an option to expand). If successful, they expand; if not, they limit losses. * **Option to Switch Suppliers:** Source equipment from multiple vendors, retaining the option to switch to the most efficient or cost-effective one as technology evolves. * **Tourism and Hospitality:** A hotel developer looking at a new property in downtown Wenatchee: * **Option to Phase Development:** Build one wing initially, with the option to add more rooms or amenities (like a spa or conference center) if tourism numbers exceed projections. * **Option to Convert:** Design the building with the flexibility to convert hotel rooms into apartments or long-term rentals if the tourism market softens. * **Local Manufacturing:** A small-scale manufacturer producing specialty food products: * **Option to Expand Production Lines:** Invest in modular equipment that allows for easy expansion or addition of new product lines as consumer tastes change. * **Option to Outsource:** Retain the option to outsource certain production steps if in-house capacity becomes a bottleneck or if external specialists offer cost advantages. These examples illustrate how local businesses can proactively build flexibility into their plans, recognizing that the "real thing" is not a static plan, but an adaptive strategy.Challenges and Considerations in Real Options Analysis

While powerful, real options analysis is not without its challenges: * **Complexity:** Valuing real options can be more complex than traditional methods, requiring specialized knowledge. * **Data Requirements:** Accurate estimation of volatility and other parameters can be difficult due to limited historical data for unique projects. * **Managerial Buy-in:** Shifting from a fixed-plan mindset to a flexible, options-based approach requires a cultural change within an organization. * **Identification Difficulty:** As mentioned, options are often embedded and not immediately obvious. It takes a keen eye to identify them. Despite these challenges, the strategic insights gained from a real options perspective often outweigh the analytical difficulties. It encourages a more robust and resilient approach to investment. It's about being prepared for situations where "all these other copy+paste sites like tinytask.xyz etc are not the real thing," and you need a truly original, adaptive solution.The Future of Strategic Investment in Wenatchee

As Wenatchee continues to grow and diversify its economy, the ability of its businesses to make smart, adaptive investment decisions will be paramount. Embracing the principles of real options Wenatchee means fostering a culture of strategic foresight and flexibility. It means understanding that the true value of a project isn't just its initial projected returns, but also the future choices it creates. In a world where change is the only constant, the businesses that thrive will be those that can adapt, innovate, and seize opportunities as they emerge. Real options provide the framework for this agility, allowing Wenatchee's entrepreneurs and established companies alike to navigate uncertainty with confidence and turn potential risks into valuable opportunities. It's about building a resilient future, grounded in "real people" and "real world" insights, ensuring that investments are not just financially sound, but strategically robust.The journey towards mastering real options begins with a shift in perspective – recognizing the inherent value in flexibility and the power of contingent decision-making. By doing so, businesses in Wenatchee can unlock new avenues for growth, build stronger foundations, and contribute to a more dynamic and prosperous local economy. What real options are you overlooking in your current business strategy? Share your thoughts and questions in the comments below, or explore our other articles on strategic business development and local economic trends.