In the dynamic world of stock market investing, information is currency, and community can be a compass. For those tracking ERHC Energy Inc. (ERHE), the various ERHE message boards have long served as vital digital gathering places. From iHub to Yahoo Finance and StockTwits, these platforms buzz with discussions, analyses, and shared insights that can be invaluable for both seasoned traders and curious newcomers. They represent a unique ecosystem where collective sentiment, breaking news, and speculative theories intertwine, offering a raw, unfiltered look into the investor psyche surrounding a particular stock.

Understanding how to effectively navigate these online communities is crucial. While they offer a wealth of potential knowledge, they also come with inherent risks, particularly in the YMYL (Your Money or Your Life) domain of financial advice. This article will delve deep into the world of ERHE message boards, exploring their structure, the types of information you can glean, the challenges you might encounter, and how to apply E-E-A-T (Expertise, Authoritativeness, Trustworthiness) principles to your own research, ensuring you extract maximum value without falling prey to common pitfalls.

Table of Contents

- The Digital Agora: Understanding ERHE Message Boards

- ERHC Energy Inc. (ERHE): A Company Overview

- The Power of Community: Sharing & Engaging on ERHE Boards

- Navigating the Nuances: Insights and Challenges of ERHE Discussions

- Key Information Streams on ERHE Message Boards

- Strategic Discussions: ERHE's Assets and Future

- Best Practices for Engaging with ERHE Message Boards

- The Evolving Landscape of ERHE Investor Communication

The Digital Agora: Understanding ERHE Message Boards

At their core, ERHE message boards are online forums dedicated to discussions surrounding ERHC Energy Inc. (ERHE) stock. Think of them as digital town squares where investors, from seasoned veterans to curious novices, gather to share their opinions, insights, and analyses. Platforms like iHub's community of investors, Yahoo Finance's forum, Investing.com, and StockTwits host the latest ERHC Energy Inc. (ERHE) discussions. These aren't just static repositories of information; they are living, breathing communities where the pulse of investor sentiment can be felt in real-time. For anyone looking to understand the collective mood or specific rumors circulating about ERHE, these boards are often the first port of call.

The sheer volume of posts—sometimes numbering in the hundreds of thousands, as seen with "ERHC Energy Inc (ERHE) post # of 364104"—underscores their active nature. While the official company filings and news releases provide the fundamental data, these message boards offer the interpretive layer, the investor reaction, and the speculative narratives that often drive short-term stock movements. They provide a space where individuals can freely "share your opinion and gain insight from other stock traders and investors," creating a rich tapestry of perspectives that is hard to find elsewhere.

A Hub for Collective Intelligence

The primary appeal of an ERHE message board lies in its ability to harness collective intelligence. No single investor has all the answers, but by pooling knowledge, experience, and research, the community can often uncover details or perspectives that individual research might miss. This is where the concept of "sharing your ideas and getting valuable insights from the community" truly comes alive. Members might highlight obscure news articles, point out patterns in charts, or offer detailed analyses of financial reports that others might have overlooked. For example, discussions might revolve around the implications of "ERHC Energy will have a new website here soon with updated information on their future plans" or the strategic importance of "CEO Pet[er Ntephe]" actions. This collaborative environment fosters a sense of shared purpose, where investors can learn from each other's successes and mistakes, collectively striving to make more informed decisions about ERHE stock.

However, it's important to remember that "collective intelligence" is not synonymous with "unanimous truth." The quality of insights varies widely, and critical discernment is always required. The most effective users of these boards understand that they are a starting point for research, not the final word. They seek out posts from individuals who demonstrate genuine expertise and a track record of insightful contributions, rather than simply following the loudest voices.

Beyond the Ticker: What You'll Find

An ERHE message board offers far more than just a place to chat. It's a comprehensive, albeit informal, data hub. You'll typically find "ERHE stock price, quote, latest community messages, chart, news and other stock related information." This means you can get a quick snapshot of the current trading activity alongside the immediate reactions and discussions from the community. Beyond the raw numbers, the qualitative data is perhaps even more compelling. The "ERHE market and community sentiment, movement in message volume, participation score and buzz level in the StockTwits community" provides a unique gauge of investor interest and emotional temperature.

Discussions often branch out into specific company developments. For instance, you might find detailed threads on "Erhc energy inc (erhe) stock research links," "recent news filings financials buy rating," or even historical events like "21, 2017 ERHC Energy Inc" updates. The boards also serve as a place where investors can scrutinize corporate governance, such as when "Board adopts new committee charters, approves management recomm[endations]." This blend of quantitative data, qualitative sentiment, and specific company news makes the ERHE message board an indispensable tool for anyone tracking the stock, offering a multifaceted view that goes beyond traditional financial news outlets.

ERHC Energy Inc. (ERHE): A Company Overview

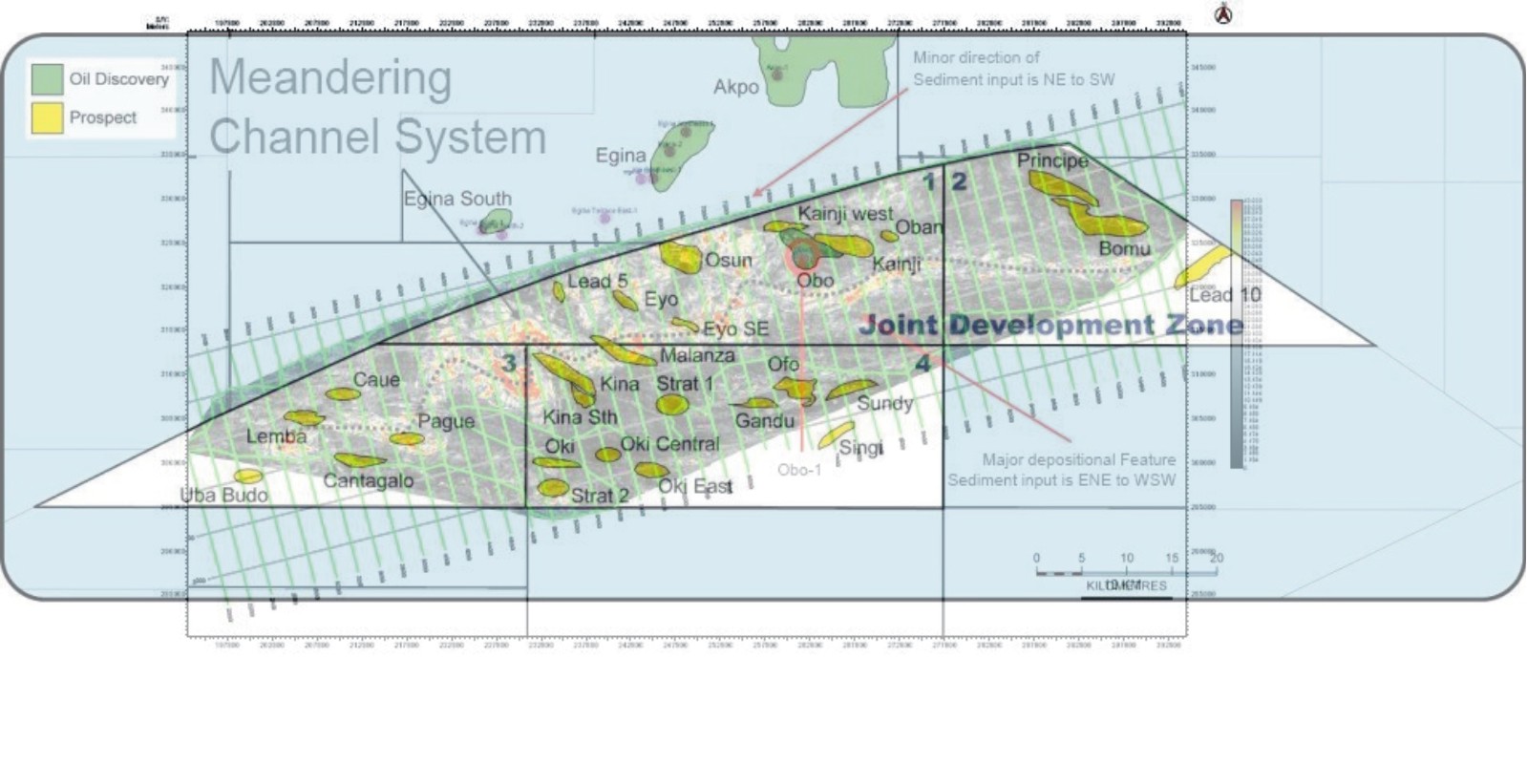

To fully appreciate the discussions on an ERHE message board, it's essential to understand the company itself. ERHC Energy Inc. (ERHE) is an oil and gas company primarily "engages in the exploration and exploitation of oil and gas resources in Africa." Its operations are focused on key regions, including "Kenya acreage, Chad acreage, exclusive economic zone," and it has also been "exploring ERHC's potential collaborations in Madagascar and Cuba." The company's principal assets include "the rights to working interests in exploration acreage in the Joint Development Zone (JDZ)" between specific countries, granted certain rights which include "the award certain working interests in future licensing rounds."

The company's journey has not been without its challenges, including discussions about "legacy debt from HTTI era." Despite these hurdles, investor interest remains high, often fueled by anticipation of future developments. "A comprehensive update for those following ERHC Energy’s developments" is a common theme on the boards, with investors keen to hear about "ERHC Energy will have a new website here soon with updated information on their future plans." The leadership, particularly "CEO Peter Ntephe," is frequently a subject of discussion, with investors scrutinizing his every move and statement for clues about the company's trajectory. Understanding these fundamental aspects of ERHE's business and its operational context is crucial for interpreting the often-passionate debates found on its dedicated message boards.

The Power of Community: Sharing & Engaging on ERHE Boards

The true essence of an ERHE message board lies in its vibrant community. It's a place where individuals are encouraged to "share your opinion and gain insight from other stock traders and investors." This interactive environment fosters a sense of belonging among those who have invested in, or are considering investing in, ERHE. Unlike passively consuming news, engaging on these boards allows for real-time dialogue, questioning, and debate. When a new piece of information emerges, such as "ERHC news investorshub newswire Luke Plants featured in U.S. Department of the Interior report to Congress on strategic review of national orphan well program," the boards immediately become a forum for dissecting its implications.

The community aspect also brings a unique dynamic: the interplay of diverse perspectives. Some investors might focus on technical analysis, dissecting "ERHC Energy (CE) stock quote and ERHE charts," while others might delve into fundamental analysis, scrutinizing "recent news filings financials." The discussions often reflect a spectrum of emotions, from cautious optimism to outright frustration, especially when addressing long-standing issues or speculative theories. The ability to "share and engage with a community of investors on the fastest growing stock message board" provides a powerful platform for collective learning and for testing one's own investment theses against the collective wisdom (or sometimes, folly) of the crowd. It's a space where the adage "to the people that have common sense" is often invoked, highlighting the community's desire for rational, well-reasoned contributions amidst the noise.

Navigating the Nuances: Insights and Challenges of ERHE Discussions

While an ERHE message board offers unparalleled access to investor sentiment and diverse perspectives, it's crucial to approach these platforms with a discerning eye. The very nature of an open forum, where anyone can post, means that the quality and accuracy of information can vary wildly. This is where the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) become paramount for the individual investor. It's not enough to simply read posts; one must evaluate the source, the evidence presented, and the potential biases of the poster.

Challenges on these boards include the prevalence of speculation, misinformation, and emotional outbursts. Discussions might swing from detailed analyses of "ERHC's common stock is traded on the OTC Bulletin Board" to highly speculative claims about future price movements. There's also the risk of "pump-and-dump" schemes, where individuals try to artificially inflate a stock's price through misleading posts before selling their shares. Conversely, some might engage in "shorting ERHE" and attempt to spread negative sentiment. This is why some platforms emphasize guidelines, as seen with "all comments included here have met investing.com's comment guidelines," but individual vigilance is always the best defense.

Distinguishing Fact from Speculation

One of the most critical skills for navigating an ERHE message board is the ability to separate verifiable facts from mere speculation or wishful thinking. A post claiming "ERHC couldn't capitalize on its assets it would declare bankruptcy and Offor wouldn't bother becoming chairman of the board" might sound authoritative, but without supporting evidence, it remains an opinion. True expertise on these boards comes from individuals who consistently back their claims with references to official company filings, news reports, or verifiable data. Look for posts that cite "ERHC Energy Inc (ERHE) stock research links," "recent news filings financials," or reputable news sources like the "WSJ."

Be wary of posts that rely solely on strong emotional language, personal attacks, or vague promises of impending breakthroughs. While sentiment is important, it should be a secondary consideration to fundamental data. Remember, anyone can claim to be an expert online, and it's up to you to verify their claims. Cross-referencing information found on the message board with official company announcements, reputable financial news sites, and regulatory filings (such as those with the "United States of America before the Securities and Exchange Commission administrative proceeding file no") is an indispensable practice.

The YMYL Imperative: Why Diligence Matters

Given that ERHE message boards deal with financial investments, they fall squarely into the YMYL (Your Money or Your Life) category. This means that inaccurate or misleading information can have direct and significant financial consequences for readers. Therefore, the responsibility for due diligence rests firmly with the individual investor. Relying solely on anonymous posts for investment decisions is a recipe for potential disaster. The principle of E-E-A-T demands that information sources are expert, authoritative, and trustworthy. While a message board itself isn't a single expert, the collective can be, provided you know how to filter. For instance, a post from a "premiummember 24 minutes ago post #363,160" might carry more weight for some, but even then, critical evaluation is key.

Your money is at stake, and every investment decision should be based on thorough, independent research, not just on what someone says on a forum. The message board should be seen as a source of ideas, questions, and potential leads for your own research, not as a definitive guide. If a claim sounds too good to be true, or too dire to be believed, it almost certainly warrants deeper investigation. This includes understanding the company's "operations include Kenya acreage, Chad acreage, exclusive economic zone, and joint" development zones, and how these factors genuinely impact its financial health, rather than just accepting a forum poster's interpretation.

Key Information Streams on ERHE Message Boards

The sheer volume of content on an ERHE message board can be overwhelming, but understanding the common types of information shared can help you navigate more effectively. Beyond general chatter, several distinct streams of information are consistently discussed:

- Stock Performance Data: Investors frequently post and analyze "ERHE stock price, quote, latest community messages, chart," and other visual representations of the stock's performance. Discussions often revolve around price targets, resistance levels, and historical trends.

- Company News and Filings: Any official announcements from ERHC Energy Inc., such as "recent news filings financials," earnings reports, or press releases, immediately become hot topics. The community dissects these for hidden meanings or future implications. News like "Luke Plants featured in U.S. Department of the Interior report to Congress on strategic review of national orphan well program" would be rigorously debated for its impact on ERHE.

- Market Sentiment and Buzz: Platforms like StockTwits provide metrics such as "movement in message volume, participation score and buzz level." These indicators offer a real-time snapshot of how engaged the community is and the overall sentiment (bullish or bearish) surrounding ERHE. A sudden spike in message volume often precedes or accompanies significant price movements.

- Strategic and Operational Updates: Discussions frequently delve into the specifics of ERHC's business operations. This includes detailed talks about their "rights to working interests in future licensing rounds in the joint development zone (JDZ)," "Kenya acreage, Chad acreage," and future prospects like "exploring ERHC's potential collaborations in Madagascar and Cuba." Updates from "CEO Peter Ntephe" regarding "future plans" are highly anticipated.

- Historical Context and Legacy Issues: Older posts or discussions often revisit past events, such as the "legacy debt from HTTI era" or previous administrative proceedings. Understanding this historical context can provide valuable perspective on the company's current challenges and opportunities.

- Rumors and Speculation: While needing careful vetting, rumors about potential partnerships, acquisitions, or major discoveries often surface first on message boards. These are typically accompanied by intense debate and attempts by the community to verify or debunk them.

By focusing on these key information streams, investors can more efficiently filter the noise and pinpoint the discussions most relevant to their research into ERHE.

Strategic Discussions: ERHE's Assets and Future

A significant portion of the discourse on an ERHE message board centers around the company's strategic direction, its assets, and its future potential. Given that ERHC Energy Inc. "engages in the business of exploration and development of oil and gas reserves," the discussions often become highly technical, delving into the intricacies of their various holdings. Investors closely monitor any news related to their "principal assets include the rights to working interests in exploration acreage in the Joint Development Zone (JDZ)" and other key areas like "Kenya acreage, Chad acreage, exclusive economic zone." The long-term value of ERHE is seen to be intrinsically tied to the successful exploitation of these resources.

Anticipation builds around "future licensing rounds" and the potential for new discoveries. The community often speculates on the financial implications of these assets, debating whether ERHC can truly "capitalize on its assets" or if the company faces the risk of "declare bankruptcy." The role of key figures like "Offor wouldn't bother becoming chairman of the board" is also scrutinized, with investors trying to infer the confidence of leadership in the company's future. Furthermore, forward-looking discussions about "ERHC Energy will have a new website here soon with updated information on their future plans" and "CEO Peter Ntephe hasn't tagged" certain updates highlight the community's eagerness for concrete progress. The possibility of "exploring ERHC's potential collaborations in Madagascar and Cuba" also sparks considerable interest, as these could represent significant growth avenues. These strategic discussions, while sometimes speculative, offer a unique window into the collective hopes and fears surrounding ERHE's long-term viability and growth prospects.

Best Practices for Engaging with ERHE Message Boards

To maximize the benefits and minimize the risks associated with ERHE message boards, adopting a few best practices is essential:

- Verify Everything: Never take a post at face value, especially when it pertains to financial information or significant company news. Always cross-reference claims with official sources like ERHC Energy's investor relations page, SEC filings, reputable financial news outlets (e.g., WSJ), or official stock exchanges.

- Understand the Poster: While anonymity is common, some users build a reputation for insightful contributions. Pay attention to consistent posters who provide well-reasoned arguments and cite sources. Be wary of brand-new accounts making extraordinary claims or overly emotional posts.

- Filter for Noise: Message boards can be noisy. Learn to quickly identify and filter out irrelevant chatter, personal attacks, or posts that offer no substantive information. Focus on threads that discuss "ERHE stock price, quote, latest community messages, chart, news and other stock related information" or specific company updates.

- Beware of Confirmation Bias: It's natural to seek out information that confirms your existing beliefs. Actively challenge your own assumptions by reading dissenting opinions and understanding their arguments, even if you ultimately disagree.

- Contribute Responsibly: If you choose to post, ensure your contributions are constructive, well-researched, and respectful. Avoid making unsubstantiated claims or engaging in personal attacks. Remember, your posts contribute to the overall quality and trustworthiness of the "ERHE message board."

- Protect Your Privacy: Be mindful of the information you share. As the data suggests, some browsers' tracking protection settings might impact your experience ("If you are not using an ad blocker but are still receiving this message, make sure your browser's tracking protection is set to the 'standard' level"). This underscores the general need for online privacy awareness.

- Form Your Own Opinion: Ultimately, the insights gained from an ERHE message board should inform, not dictate, your investment decisions. Combine community sentiment with your own fundamental and technical analysis before taking any action.

The Evolving Landscape of ERHE Investor Communication

The world of online investor communication, including the ERHE message board, is constantly evolving. What began as simple text-based forums has grown into sophisticated platforms offering real-time data, sentiment analysis, and multimedia content. The drive for "the fastest growing stock message board" reflects a continuous innovation in how investors connect and share information. While the core function—to discuss and analyze ERHC Energy Inc. (ERHE)—remains, the tools and features available to users are always improving.

This evolution also means that investors must remain adaptable. New platforms might emerge, or existing ones might introduce new features that change how information is consumed and shared. The emphasis on community and shared insights, however, is likely to remain a constant. As ERHC Energy Inc. itself progresses, potentially with "a new website here soon with updated information on their future plans," the investor community will continue to adapt its discussions to reflect these developments. The enduring appeal of the ERHE message board lies in its dynamic nature, its capacity to reflect the immediate pulse of the market, and its potential to foster a collective understanding of a company's journey, even amidst its "challenges and opportunities." It's a testament to the power of decentralized information sharing in the digital age, proving that the collective wisdom of investors, when harnessed responsibly, can be a formidable force.

In conclusion, the ERHE message board stands as a powerful, albeit complex, resource for anyone interested in ERHC Energy Inc. (ERHE) stock. It offers a unique window into investor sentiment, provides a platform for diverse analyses, and can be a valuable source of early information. However, its utility is directly proportional to the critical thinking and due diligence applied by its users. By understanding the company, navigating the discussions with a discerning eye, and applying E-E-A-T principles to every piece of information, investors can transform these digital forums from mere chat rooms into indispensable tools for informed decision-making in the YMYL world of finance. What are your thoughts on the future of ERHE, and how do you leverage online communities in your investment research? Share your insights and join the ongoing discussion below!