In the rapidly evolving landscape of decentralized finance (DeFi), innovation is the lifeblood that propels the ecosystem forward. As new protocols emerge, each promises to solve unique challenges, enhance user experience, or unlock unprecedented opportunities. Among these, the concept of a "Steer Protocol" stands out, not just for its potential technical prowess but for the profound metaphor embedded within its very name. This isn't merely about another set of smart contracts; it's about bringing a sense of controlled direction and predictable efficiency to the often-unpredictable currents of digital asset management.

To truly grasp the essence of a Steer Protocol, one must first appreciate the etymology and the inherent characteristics of the word "steer" itself. Just as a steer, the castrated male bovine, is known for its docility, its controlled growth, and its ultimate purpose in yielding valuable resources, so too does a Steer Protocol aim to guide, optimize, and stabilize the flow of capital within DeFi. It's about taking the raw, often volatile energy of the market and channeling it into productive, predictable pathways, much like a skilled hand steers a vessel through turbulent waters or guides a vehicle along a precise route. This article delves into the foundational principles, potential applications, and transformative impact that a well-conceived Steer Protocol could bring to the decentralized financial world.

Table of Contents

- Understanding the Steer Metaphor in DeFi

- The Core Problem Steer Protocol Aims to Solve

- How Steer Protocol Could Function: Mechanisms and Architecture

- The Benefits of Implementing a Steer Protocol

- Real-World Applications and Use Cases

- The Importance of Security and Audits

- Challenges and Future Outlook for Steer Protocol

- Conclusion: Steering DeFi Towards a Smarter Future

Understanding the Steer Metaphor in DeFi

At its heart, the concept of a "Steer Protocol" is deeply rooted in the very definition of the word "steer." When we talk about cattle, **a steer is a male domesticated bovine that has been castrated**. This act of castration, typically performed on male calves not intended for breeding, serves a specific purpose: to make them more docile, easier to manage, and to optimize their growth for beef production. The meaning of steer, therefore, encapsulates a controlled, directed outcome. Unlike a bull, which might be wild and unpredictable, a steer is calm, predictable, and focused on its purpose. This little hair is pretty much the only way to tell if this animal you are looking at is a steer, highlighting that the difference lies not in brute strength but in managed behavior. Steers typically appear more feminine than bulls do, lacking the characteristic muscular aggression, further emphasizing their controlled nature. Translating this into the realm of decentralized finance, a Steer Protocol embodies these very principles. Just as a steer is guided towards a specific, productive outcome (beef), a Steer Protocol aims to guide capital towards optimal, predictable yields. It's about taking the raw, often chaotic energy of decentralized markets – with their inherent volatility, impermanent loss risks, and complex yield farming strategies – and "castrating" the unpredictable elements. It seeks to remove the "wildness" and introduce docility, allowing users to "control the direction of a vehicle" (their investments) or "direct the course of a vessel" (their capital) through the use of sophisticated algorithms and automated strategies. If a vehicle steers, it follows a particular route or... a predetermined, optimized path. This philosophical alignment is crucial to understanding the fundamental value proposition of a Steer Protocol: bringing order, predictability, and efficiency to DeFi.The Core Problem Steer Protocol Aims to Solve

Decentralized finance, while revolutionary, is not without its significant challenges. For the average user, navigating the myriad of protocols, understanding complex yield farming strategies, and managing the risks associated with providing liquidity can be overwhelming. The primary issues that a robust Steer Protocol would seek to address include: * **Capital Inefficiency:** Many liquidity pools suffer from inefficient capital utilization. Assets often sit idle, or are deployed in a sub-optimal range, leading to lower yields for liquidity providers (LPs). * **Impermanent Loss (IL):** This is a pervasive risk for LPs, where the value of their deposited assets can decrease relative to simply holding them, due to price fluctuations between the paired assets in a liquidity pool. IL is a major deterrent for many potential LPs. * **Complexity of Yield Optimization:** To achieve the best returns, users often need to constantly monitor market conditions, move assets between different protocols, and adjust their strategies. This requires significant time, expertise, and often incurs high gas fees. * **Slippage and Execution Risk:** Large trades can suffer from significant slippage in low-liquidity pools, impacting profitability. Furthermore, manual execution of trades or rebalancing strategies can be slow and prone to errors. * **Accessibility Barriers:** The technical complexity of DeFi can deter mainstream adoption. A simplified, automated solution is crucial for onboarding new users. In essence, the DeFi landscape often feels like an untamed range, full of potential but also significant hazards. A Steer Protocol would act as the experienced rancher, guiding the herd (capital) to the most fertile pastures (highest yields) while minimizing exposure to predators (risks). It aims to "steer you to the best restaurant in town," but for your digital assets.How Steer Protocol Could Function: Mechanisms and Architecture

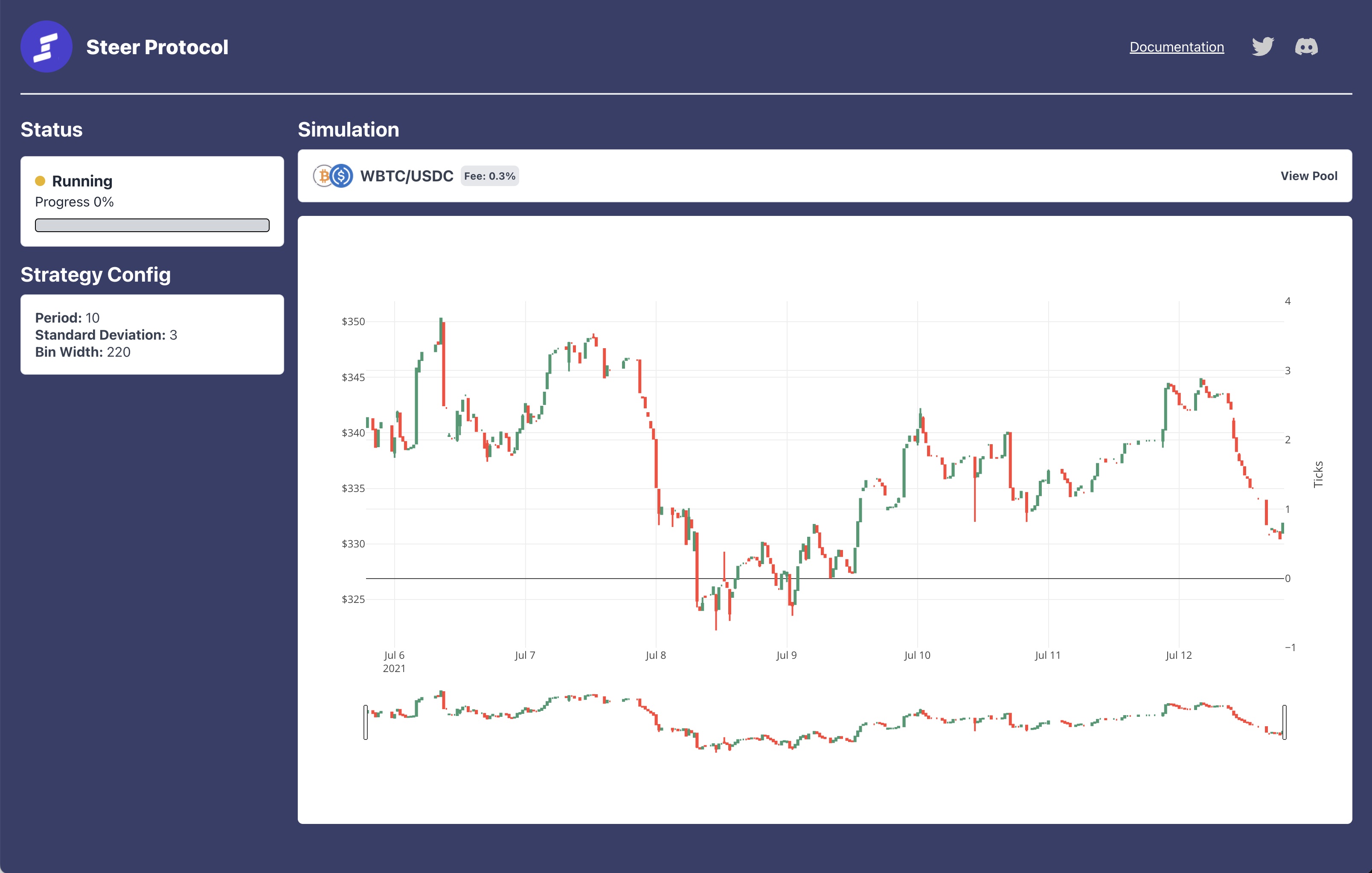

A conceptual Steer Protocol would operate as an intelligent layer built on top of existing decentralized exchanges (DEXs) and lending protocols. Its core functionality would revolve around automated, dynamic management of liquidity and capital, leveraging advanced algorithms and potentially machine learning to optimize returns and mitigate risks. ### Dynamic Liquidity Provision and Optimization The primary mechanism would involve smart contracts that actively manage liquidity positions. Unlike traditional static liquidity provision, where assets are deposited at a fixed ratio across the entire price range, a Steer Protocol would employ concentrated liquidity strategies. This means: * **Automated Rebalancing:** The protocol would constantly monitor the price movements of assets within a liquidity pool. When prices move outside a predefined optimal range, the protocol would automatically rebalance the liquidity, shifting it to where it can earn the most fees. This is akin to "directing the course of a vessel" to stay within the most profitable currents. * **Adaptive Range Management:** Instead of a fixed range, the protocol could dynamically adjust the price range for concentrated liquidity based on volatility, trading volume, and projected price movements. This allows for higher capital efficiency, as capital is always deployed where it's most likely to generate fees. This proactive adjustment is key to minimizing impermanent loss and maximizing fee capture. * **Multi-Protocol Integration:** A sophisticated Steer Protocol wouldn't be limited to a single DEX. It could integrate with multiple liquidity sources (e.g., Uniswap V3, Balancer, Curve) and lending protocols (e.g., Aave, Compound) to identify and route capital to the highest-yielding opportunities across the DeFi ecosystem. This comprehensive approach ensures that capital is always "steered" towards the most profitable avenues. ### Risk Mitigation and Capital Efficiency Beyond yield optimization, a Steer Protocol would integrate features designed to protect user capital and enhance overall efficiency: * **Impermanent Loss Protection/Mitigation:** While complete elimination of IL is challenging, the protocol could employ strategies such as: * **Hedging:** Using derivatives or other financial instruments to offset potential losses from price divergence. * **Dynamic Fee Tiers:** Adjusting the fees charged for liquidity provision based on volatility, incentivizing LPs for higher risk. * **Automated Stop-Loss/Take-Profit:** Users could set parameters for automated withdrawal or rebalancing if certain price thresholds are met, protecting against significant downside or locking in gains. * **Gas Fee Optimization:** By batching transactions and executing rebalances at optimal times (e.g., during off-peak network hours), the protocol could significantly reduce the gas costs associated with active liquidity management, making it more accessible for smaller capital providers. * **Security Audits and Decentralization:** Given the YMYL (Your Money or Your Life) nature of financial protocols, a Steer Protocol would necessitate rigorous security audits by reputable third parties. Furthermore, progressive decentralization of governance, allowing token holders to "steer" the protocol's development and parameters, would build trust and resilience.The Benefits of Implementing a Steer Protocol

The adoption of a well-designed Steer Protocol could usher in a new era of efficiency and accessibility in DeFi, offering tangible benefits to a wide range of users. ### Enhanced Yields and Reduced Slippage For liquidity providers, the primary draw would be the potential for significantly higher, more consistent yields. By actively managing positions and optimizing capital deployment, the protocol ensures that LPs are earning fees on a much larger portion of their deposited assets. This dynamic approach can lead to: * **Higher APRs/APYs:** Automated rebalancing and adaptive range management allow for more efficient fee capture, translating directly into better returns for LPs. While specific numbers vary wildly based on market conditions, well-managed concentrated liquidity positions can outperform static ones by multiples. * **Reduced Impermanent Loss Impact:** While not entirely eliminated, the proactive management of positions helps to mitigate the effects of impermanent loss, making liquidity provision a less risky endeavor. * **Improved Market Depth and Reduced Slippage:** By ensuring that liquidity is always concentrated where it's most needed, the protocol contributes to deeper liquidity pools. This benefits traders by reducing slippage on large orders, leading to more efficient and cost-effective trades across the ecosystem. This makes the market more robust, much like a well-managed herd makes for a more stable farm. ### Simplified User Experience Perhaps one of the most transformative benefits of a Steer Protocol is its ability to democratize access to sophisticated DeFi strategies. * **Set-and-Forget Convenience:** Users would no longer need to constantly monitor charts, perform complex calculations, or manually rebalance their positions. They could simply deposit their assets into the Steer Protocol, and the underlying algorithms would handle the rest, acting as a tireless, expert fund manager. This aligns with the docility of a steer, making it easy to manage. * **Lower Barrier to Entry:** The complexity of concentrated liquidity and yield optimization is a significant hurdle for new users. A Steer Protocol abstracts away this complexity, making advanced strategies accessible to anyone, regardless of their technical expertise or time commitment. * **Increased Confidence:** By providing a more stable and optimized environment for capital, the protocol can instill greater confidence in users, encouraging broader participation in liquidity provision and other DeFi activities. This trust is crucial for the long-term growth and stability of the decentralized financial system.Real-World Applications and Use Cases

The applications of a Steer Protocol are broad and impactful, extending across various facets of the DeFi landscape: * **Automated Liquidity Management for DEXs:** This is the most direct application. Users could deposit assets into a Steer Protocol vault, which then automatically manages concentrated liquidity positions on Uniswap V3, PancakeSwap v3, or other similar DEXs. This would be a game-changer for LPs seeking passive income. * **Optimized Yield Farming Strategies:** Beyond basic liquidity provision, a Steer Protocol could be designed to automatically farm yields across multiple protocols, moving assets between different lending platforms, staking opportunities, and liquidity pools based on real-time APY data and risk parameters. * **Treasury Management for DAOs:** Decentralized Autonomous Organizations (DAOs) often hold significant treasuries in various digital assets. A Steer Protocol could provide a secure and efficient way for DAOs to manage their funds, optimize their treasury's growth, and ensure liquidity for operational needs without requiring constant manual intervention. This allows the DAO to "steer" its resources effectively. * **Institutional Adoption:** As institutions eye the DeFi space, the need for robust, automated, and risk-managed solutions becomes paramount. A Steer Protocol, with its emphasis on efficiency and control, could provide the necessary infrastructure for institutional capital to enter DeFi more confidently. * **Structured Products and Index Funds:** The underlying mechanisms of a Steer Protocol could be used to create more sophisticated structured products or passively managed DeFi index funds, offering diversified exposure and optimized returns to a broader investor base.The Importance of Security and Audits

Given that a Steer Protocol would directly manage users' financial assets, security is not just important; it is paramount. The YMYL (Your Money or Your Life) criteria apply here with full force. Any protocol dealing with significant sums of money must prioritize robust security measures to build and maintain user trust. Key security considerations for a Steer Protocol would include: * **Smart Contract Audits:** Before deployment and periodically thereafter, all smart contracts governing the protocol must undergo comprehensive audits by multiple reputable blockchain security firms. These audits identify vulnerabilities, logical flaws, and potential attack vectors. * **Formal Verification:** For critical components, employing formal verification methods can mathematically prove the correctness of the code, significantly reducing the risk of bugs. * **Multi-Signature Wallets and Time Locks:** For protocol upgrades or significant changes, implementing multi-signature requirements for execution and time locks (where changes only take effect after a set period) adds layers of security and transparency. * **Bug Bounty Programs:** Encouraging white-hat hackers to find and report vulnerabilities through bug bounty programs is an effective way to continuously improve security. * **Decentralized Governance:** While initial development might be centralized, a progressive decentralization roadmap, where token holders eventually control key parameters and upgrades, reduces single points of failure and enhances community oversight. This ensures that the community can collectively "steer" the protocol safely. * **Transparency:** All operations, rebalancing events, and fee structures should be transparent and verifiable on-chain, allowing users to understand how their capital is being managed. Without an unwavering commitment to security, even the most innovative Steer Protocol would fail to gain widespread adoption. Trust, in the decentralized world, is built on verifiable security and transparent operations.Challenges and Future Outlook for Steer Protocol

While the potential of a Steer Protocol is immense, its development and widespread adoption would face several challenges: * **Technical Complexity:** Building a truly intelligent and adaptive protocol that can navigate the nuances of multiple DEXs and market conditions is a significant technical undertaking. * **Gas Costs:** Even with optimization, frequent rebalancing on high-traffic blockchains like Ethereum can still incur substantial gas fees, potentially eroding profits for smaller capital providers. Layer 2 solutions and other scaling technologies will be crucial here. * **Oracle Dependence:** Accurate and reliable price feeds (oracles) are critical for dynamic rebalancing. Dependence on external oracles introduces potential attack vectors if they are compromised. * **Competition:** The DeFi space is highly competitive, with many existing yield optimizers and liquidity management solutions. A Steer Protocol would need to offer a distinct and superior value proposition. * **Regulatory Uncertainty:** The evolving regulatory landscape for cryptocurrencies and DeFi could impact the operation and accessibility of such protocols. Despite these challenges, the future outlook for concepts like a Steer Protocol remains incredibly promising. As DeFi matures, the demand for more sophisticated, automated, and user-friendly solutions will only grow. The ability to "steer" capital efficiently and securely through the complexities of decentralized markets is not just a luxury but a necessity for mass adoption. We can expect to see: * **Increased AI/ML Integration:** More advanced protocols will leverage artificial intelligence and machine learning to predict market movements, optimize rebalancing strategies, and even anticipate impermanent loss. * **Cross-Chain Capabilities:** Future Steer Protocols will likely operate seamlessly across multiple blockchain networks, allowing users to tap into liquidity and yield opportunities regardless of the underlying chain. * **Enhanced Risk Management Tools:** More granular control over risk parameters, personalized risk profiles, and insurance mechanisms will become standard features. The metaphor of the "steer" – controlled, purposeful, and optimized for yield – provides a powerful vision for the future of DeFi. Protocols that can embody these characteristics will be instrumental in guiding the ecosystem towards greater stability, efficiency, and accessibility.Conclusion: Steering DeFi Towards a Smarter Future

The concept of a **Steer Protocol** represents a significant leap forward in the evolution of decentralized finance. By drawing inspiration from the very nature of a "steer" – an animal known for its docility, controlled growth, and utility – this type of protocol aims to bring much-needed stability, efficiency, and predictability to the often-volatile world of digital assets. It promises to transform complex liquidity provision and yield optimization into a streamlined, automated experience, effectively "steering" user capital towards optimal returns while mitigating inherent risks. From dynamic liquidity management and impermanent loss mitigation to simplified user interfaces and enhanced capital efficiency, the potential benefits are clear. As DeFi continues its journey towards mainstream adoption, solutions that abstract away complexity and prioritize user experience, while maintaining robust security, will be paramount. A well-designed Steer Protocol could be the rudder that helps guide both novice and experienced investors through the turbulent waters of decentralized markets, ensuring their financial "vessel" follows the most profitable and secure course. What are your thoughts on the future of automated liquidity management in DeFi? Share your insights in the comments below, or explore our other articles on the latest innovations in decentralized finance. The future of finance is being steered, and you have a front-row seat.