In the fast-evolving landscape of digital finance, understanding every nuance of online transactions is paramount, and among these, the "stripelink message" stands as a critical element. This message, often a subtle yet powerful communication, plays a pivotal role in ensuring the security, efficiency, and trustworthiness of your online payments.

From confirming successful transactions to alerting you about potential issues, these messages are the digital handshake between you, the merchant, and the payment gateway. But what exactly do they signify, and how can you interpret them to safeguard your financial interactions? This comprehensive guide will delve into the world of Stripe Link messages, demystifying their purpose and empowering you with the knowledge to navigate the digital payment realm with confidence.

Table of Contents

- What is a "Stripe Link Message"? Unpacking the Core Concept

- The Anatomy of Trust: How Stripelink Messages Ensure Security

- Types of Stripelink Messages You Might Encounter

- The User Experience: Streamlining Payments with Link and Its Messages

- Beyond Payments: The Universal Principle of Data Verification and Secure Communication

- Best Practices for Users: Managing Your Stripelink Messages

- For Merchants: Optimizing Your Use of Stripe Link and Messaging

- The Future of Digital Payment Messaging

What is a "Stripe Link Message"? Unpacking the Core Concept

At its core, a "Stripe Link message" refers to any communication or notification generated by or related to Stripe Link, a powerful feature designed by Stripe to simplify online checkouts. Stripe Link allows users to save their payment information (like card details and shipping addresses) securely with Stripe, enabling one-click purchases across thousands of businesses that use Stripe. This significantly speeds up the checkout process, making online shopping smoother and more convenient.

The "message" aspect of a Stripe Link message encompasses a broad range of digital communications. These aren't just simple text alerts; they are sophisticated notifications designed to keep users informed, confirm actions, and enhance security. They can appear as emails, in-app notifications, or even direct prompts within the checkout flow. Their primary purpose is to provide transparency and build trust between the user, the merchant, and the payment platform. Without clear and timely messages, users would be left guessing about the status of their transactions, potentially leading to anxiety, confusion, or even fraudulent activity going unnoticed. Thus, every stripelink message is a vital piece of the digital payment puzzle, ensuring that all parties are on the same page and that the transaction proceeds as expected.

The Anatomy of Trust: How Stripelink Messages Ensure Security

In the realm of online finance, security is not just a feature; it's the foundation upon which trust is built. Every "stripelink message" is intricately designed with this principle in mind, acting as a crucial component in Stripe's robust security architecture. When you receive a message related to your Stripe Link account or a transaction, it's a testament to the multi-layered security measures in place to protect your sensitive financial data.

Encryption and Data Protection

One of the primary ways Stripe ensures security is through advanced encryption. All payment information saved with Link, and subsequently communicated through a stripelink message, is encrypted both in transit and at rest. This means that your card numbers, bank details, and personal information are scrambled into unreadable code, making them virtually impenetrable to unauthorized access. When a message confirms a transaction, it's built upon this secure data foundation, assuring you that your information has been handled with the highest level of cryptographic protection.

Authentication and Verification

Stripelink messages often play a role in user authentication. For instance, if you're logging into your Link account or making a significant change, you might receive a message prompting you for a two-factor authentication (2FA) code. This extra layer of security ensures that even if someone has your password, they cannot access your account without the second verification step, typically sent to your registered mobile device. Similarly, when a transaction is processed, the system implicitly verifies your saved payment method, and the subsequent confirmation message serves as an explicit verification that the payment was successful using your authenticated Link details.

Fraud Prevention Alerts

Stripe employs sophisticated machine learning algorithms to detect and prevent fraudulent transactions. If unusual activity is detected on your Link-saved payment methods, you might receive a proactive stripelink message alerting you to potential fraud. These alerts are critical for YMYL (Your Money or Your Life) scenarios, as they empower users to quickly identify and report suspicious activity, potentially saving them from financial loss. This proactive communication is a cornerstone of building a trustworthy payment ecosystem.

User Control and Transparency

A key aspect of security is giving users control over their data. Stripelink messages related to account management, such as updates to your saved payment methods or changes to your profile, reinforce this control. They provide transparency, ensuring you are aware of every action taken with your Link account. This transparency fosters confidence, as you know exactly what information is being used and how it's being managed. In essence, every stripelink message isn't just an update; it's a reaffirmation of the secure environment Stripe strives to maintain for its users.

Types of Stripelink Messages You Might Encounter

The "stripelink message" isn't a singular type of communication; rather, it's an umbrella term for various notifications that keep you informed about your transactions and account activity. Understanding these different types can help you better manage your digital finances and respond appropriately when needed.

- Transaction Confirmations: These are perhaps the most common and welcome stripelink messages. After a successful purchase using Stripe Link, you'll typically receive a confirmation message. This message usually includes details such as the merchant's name, the amount charged, the date of the transaction, and sometimes a transaction ID. It serves as your digital receipt and assurance that your payment went through smoothly.

- Failed Transaction Notifications: Unfortunately, not all transactions are successful. If a payment fails when using Link, you'll receive a stripelink message explaining why. Common reasons include insufficient funds, an expired card, incorrect card details, or a bank decline. These messages are crucial as they prompt you to take corrective action, such as updating your payment method or contacting your bank.

- Security Alerts: Stripe is vigilant about protecting your account. If the system detects any unusual or suspicious activity related to your Link account – such as a login attempt from an unrecognized device or location, or a potentially fraudulent transaction – you'll receive a security alert stripelink message. These are critical "Your Money or Your Life" alerts, urging you to review the activity and report it if it wasn't you.

- Link Account Management Messages: These messages pertain to the management of your saved Link details. This could include confirmations for password resets, email address changes, or updates to your saved payment methods (e.g., adding a new card, deleting an old one). They ensure that you are always aware of modifications to your personal and financial information stored with Link.

- Refund Notifications: When a merchant processes a refund for a purchase made with Stripe Link, you'll receive a stripelink message confirming the refund. This message typically includes the amount refunded, the original transaction details, and an indication of when you can expect the funds to appear back in your account.

- Subscription Updates: For recurring payments or subscriptions managed through Stripe Link, you might receive messages regarding upcoming charges, successful renewals, or changes to your subscription plan. These messages help you keep track of your ongoing financial commitments.

Each of these stripelink messages serves a distinct purpose, collectively contributing to a transparent, secure, and user-friendly payment experience. Paying attention to these communications is a key aspect of responsible digital financial management.

The User Experience: Streamlining Payments with Link and Its Messages

The core promise of Stripe Link is to streamline the online checkout experience. A significant part of delivering on this promise lies in the effectiveness and clarity of the "stripelink message." These messages are not just functional; they are integral to shaping a positive user experience, fostering confidence, and reducing friction in the payment process.

How Link Simplifies Checkout

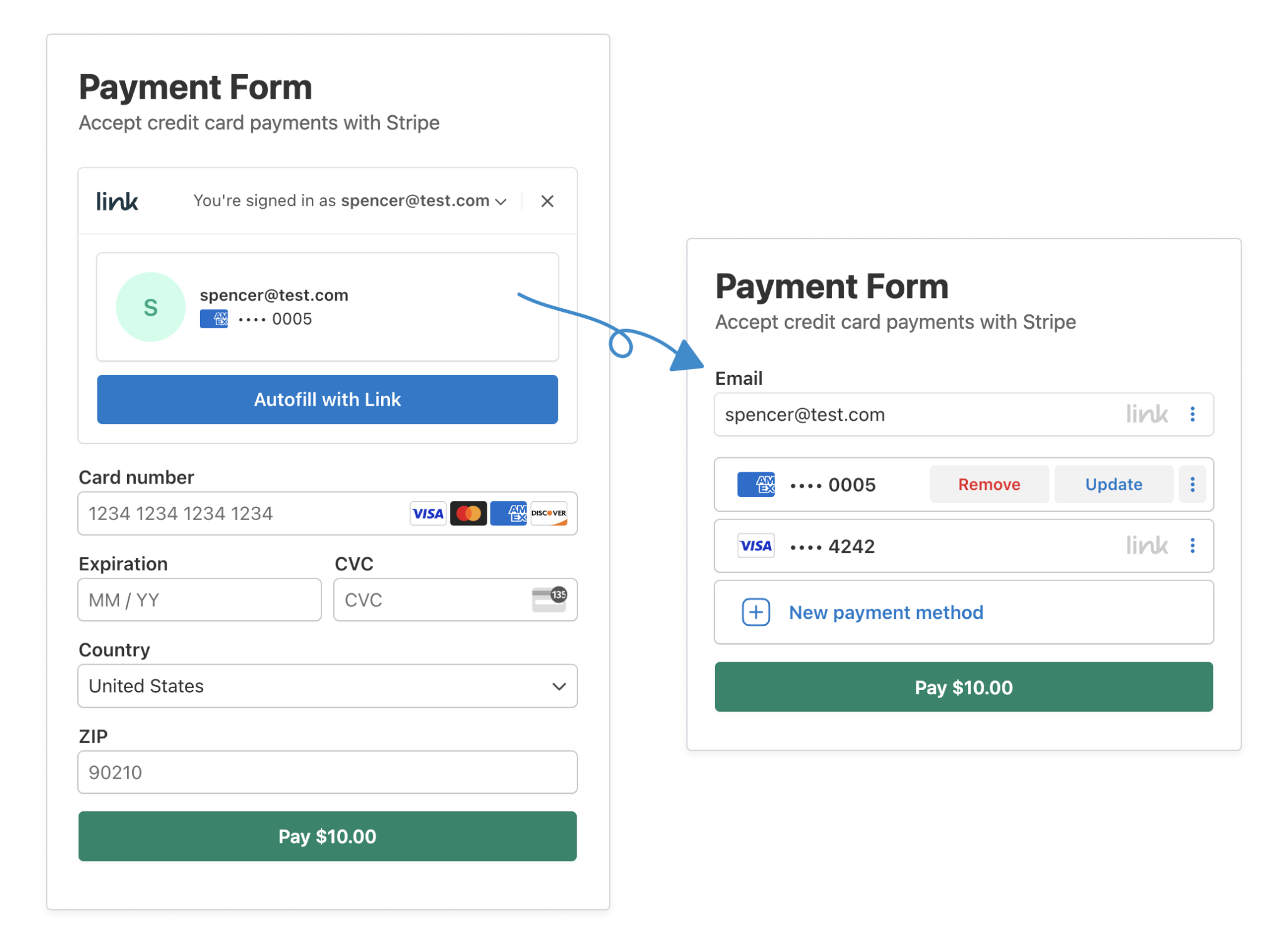

Imagine the typical online checkout: you navigate to the payment page, painstakingly enter your credit card number, expiration date, CVV, billing address, and shipping address. This repetitive process is a common source of frustration and cart abandonment. Stripe Link eliminates this by allowing users to save their details once with Stripe. Then, on any website that uses Stripe, you simply enter your email, receive a one-time password (OTP) or use a biometric login, and your saved details are pre-filled, enabling a one-click purchase. This convenience is revolutionary for frequent online shoppers.

How Messages Enhance User Confidence and Reduce Friction

The "stripelink message" plays a crucial role in making this streamlined experience feel secure and trustworthy. When a user completes a one-click purchase, a swift and clear confirmation message provides immediate reassurance that the transaction was successful. This instant feedback reduces anxiety and validates the convenience of the Link system. Conversely, if a transaction fails, a precise message explaining the reason (e.g., "Card expired") allows the user to quickly rectify the issue without frustration, rather than guessing what went wrong.

- Immediate Feedback: Users appreciate knowing the outcome of their actions instantly. A prompt stripelink message confirming success or explaining failure contributes to a feeling of control and transparency.

- Reduced Uncertainty: By clearly communicating status updates, security alerts, and account changes, these messages eliminate ambiguity. This clarity is vital for maintaining user trust, especially in financial transactions.

- Personalization and Relevance: While many messages are standard, Stripe aims for relevance. A message tailored to a specific transaction or account event feels more personal and helpful, further enhancing the user's perception of a well-managed and attentive service.

In essence, the stripelink message acts as a continuous dialogue between the payment system and the user. It transforms what could be an opaque, anxiety-inducing process into a transparent, efficient, and ultimately satisfying experience. This focus on clear, timely, and relevant communication is what truly elevates the user experience with Stripe Link, making it a preferred choice for millions of online transactions globally.

Beyond Payments: The Universal Principle of Data Verification and Secure Communication

While our primary focus has been on the "stripelink message" within the context of digital payments, it's important to recognize that the underlying principles it embodies – data verification, validation, and secure communication – are universal and critical across virtually all online services that handle sensitive information. Whether it's your money, your personal identity, or vital educational records, the integrity of data and the clarity of communication are paramount.

Consider, for instance, the online services provided by Kemdikbud (the Indonesian Ministry of Education and Culture) for user authentication and the verification and validation of student data (known as 'vervalpd'). As the provided data highlights, "Verifikasi dan validasi (verval) data pendidikan adalah langkah penting untuk memastikan keakuratan dan validitas informasi." This process, much like the secure messaging in financial systems, ensures the integrity of educational data. "Dengan proses ini, integritas data pendidikan dapat terjaga." The "Portal untuk verifikasi dan validasi data peserta didik (pd)" serves as a vital hub, ensuring "data siswa bisa lebih terkelola dengan baik dan akurat."

The parallels between a stripelink message and the Kemdikbud vervalpd system, though operating in vastly different domains, are striking in their shared objectives:

- Accuracy and Validity: Just as a stripelink message confirms the accuracy of a financial transaction, the Kemdikbud system's vervalpd process ensures that student data (like names, birth dates, and parent details) is accurate and valid, often by cross-referencing with official documents like family cards. The data states, "Vervalpd adalah web pendataan nisn dan validasi data siswa sesuai kartu keluarga."

- User Authentication: Both systems require robust user authentication. For Stripe Link, it's about verifying the legitimate cardholder. For Kemdikbud, it's about authenticating school operators or administrators who are authorized to access and modify student data. The Kemdikbud service is specifically for "autentikasi pengguna dan verifikasi serta validasi data peserta didik."

- Data Integrity: The goal in both scenarios is to maintain data integrity. A corrupted financial transaction record or an inaccurate student record can have severe consequences. The Kemdikbud system explicitly aims to ensure that "integritas data pendidikan dapat" be maintained.

- Clear Communication and Action: Whether it's a stripelink message alerting you to a failed payment or instructions from Kemdikbud on "cara verifikasi dan validasi (verval) nomor ponsel siswa untuk bantuan kuota internet" via "vervalpdnew.data.kemdikbud.go.id/vervalponsel," clear communication is essential for users to take necessary actions. Similarly, instructions like "Cara edit nama, tanggal lahir, dan nama ibu kandung siswa di dapodik dengan melakukan verval pd pada website vervalpd.data.kemdikbud.go.id" highlight the need for precise guidance.

- Identifying and Rectifying Issues: Just as financial alerts flag suspicious activity, the Kemdikbud portal's "laman awal verval pd menampilkan diagram residu yaitu data valid dan data yang membutuhkan perbaikan atau verval." This "residue diagram" directly mirrors the need to identify and correct data errors, ensuring the overall health and reliability of the dataset. "Selain itu juga menampilkan jumlah pengajuan."

In essence, the "stripelink message" and the Kemdikbud vervalpd system are two distinct manifestations of a universal digital imperative: to build and maintain trust through meticulous data handling and transparent, secure communication. They both underscore the critical importance of ensuring that the information we rely on in the digital world, whether financial or educational, is always accurate, verified, and protected.

Best Practices for Users: Managing Your Stripelink Messages

Understanding the significance of a "stripelink message" is only half the battle; knowing how to effectively manage and respond to these communications is equally vital. As a user of Stripe Link, adopting certain best practices can significantly enhance your security and ensure a smooth experience with your online transactions.

- Verify the Sender: Always double-check the sender's email address or notification source. Phishing attempts often mimic legitimate communications to trick you into revealing sensitive information. A genuine stripelink message will typically come from an official Stripe domain (e.g., stripe.com) or from the merchant directly if it's a transaction confirmation. Be wary of generic greetings or unusual sender addresses.

- Do Not Click Suspicious Links: If a stripelink message seems even slightly off, avoid clicking on any embedded links. Instead, if you need to check your Stripe Link account or a transaction status, manually navigate to the official Stripe website (stripe.com) or the merchant's website and log in directly. This bypasses any potentially malicious redirect links.

- Keep Your Contact Information Updated: Ensure that the email address and phone number associated with your Stripe Link account are current. This guarantees that you receive all critical stripelink messages, including security alerts and transaction confirmations, in a timely manner. Outdated contact details can lead to missed alerts and potential security vulnerabilities.

- Regularly Review Transaction History: Periodically log into your Stripe Link account or review your bank/credit card statements. Cross-reference these with the stripelink messages you've received. This proactive approach helps you quickly identify any unauthorized transactions or discrepancies that might have slipped past initial alerts.

- Report Suspicious Activity Immediately: If you receive a stripelink message that you believe is fraudulent, or if you notice any unauthorized transactions, report it to Stripe's support team immediately. Timely reporting can help mitigate potential financial losses and contribute to the overall security of the Stripe ecosystem.

- Use Strong, Unique Passwords: While Stripe Link offers passwordless login options, if you do use a password, ensure it's strong, unique, and not reused across multiple services. Consider using a password manager to securely store complex passwords.

- Enable Two-Factor Authentication (2FA): For an added layer of security, enable 2FA on your Stripe Link account if available. This means that even if your password is compromised, an attacker would still need access to your secondary device (e.g., your phone) to log in.

By diligently following these best practices, you empower yourself to navigate the digital payment landscape with greater confidence and significantly reduce your exposure to risks associated with online financial transactions. Every stripelink message is a tool; knowing how to use it wisely is your best defense.

For Merchants: Optimizing Your Use of Stripe Link and Messaging

For businesses utilizing Stripe for their payment processing, leveraging Stripe Link and understanding the implications of the "stripelink message" extends beyond just offering a faster checkout. It involves optimizing the integration to enhance customer trust, streamline operations, and ultimately boost conversion rates. Merchants play a crucial role in the user's experience with Link, and their approach to communication can make a significant difference.

- Clearly Communicate Link's Benefits: Educate your customers about what Stripe Link is and how it benefits them (e.g., faster checkout, secure saving of details). A brief explanation on your checkout page can encourage adoption. While the direct stripelink message comes from Stripe, your site's messaging sets the stage.

- Ensure Seamless Integration: A smooth integration of Stripe Link into your checkout flow is paramount. Any glitches or confusing steps can undermine the convenience that Link promises. Test your checkout process thoroughly to ensure that the transition to and from the Link experience is flawless, complementing the clarity of the stripelink message users receive.

- Monitor Transaction Statuses: Merchants should actively